The Linkages case study, titled “Persistence against the odds: Bentworth’s entry into oil and gas supply” sets out Bentworth’s journey to becoming the first Kenyan indigenous oilfield services company.

It all began when “Baker Hughes a leading oilfield service company based out of Houston, needed a local supplier of coiled tubing services in Kenya. When no such local service provider existed it helped a local entrepreneur with an appetite for risk to enter this highly specialised sector.”

The challenge for new entrants into the oil and gas sector is that “opportunities for greenfield entrepreneurship can be rare. Well-established international firms spend millions of dollars in research and development, protecting there investments with copyrights and patents. This required technology and capital investment forms an almost impenetrable barrier for domestic entrepreneurs in oil-producing nations.”

“Ironically, this dynamic often presents a challenge for multinational companies operating in contexts where demand for local content requires that they contribute the development of domestic firms. This was the case for Baker Hughes.”

Baker Hughes had a contract with Tullow Oil to operate various well services. Potentially this could include a coiled tubing unit. This presented Baker Hughes a good opportunity to respond to local content demands.”

So began a conversation between Torks Azeez, Baker Hughes’ Regional Head and Carey Ngini.

“Carey Ngini, is a former Lloyd’s of London reinsurance broker turned entrepreneur. With the discovery of oil and gas in Kenya, Carey saw new, viable business opportunities.”

“While researching the sector, Carey came across Baker Hughes and soon met with Torks, settling on an initial approach: Bentworth would acquire a coiled tubing unit and deliver services to Tullow’s project through its relationship with Baker Hughes, which would take the lead on the tendering process.”

“Baker Hughes provided Bentworth with a complete set of blueprints of how to set up, run, and operate the coiled tubing unit, including manufacturing specifications.”

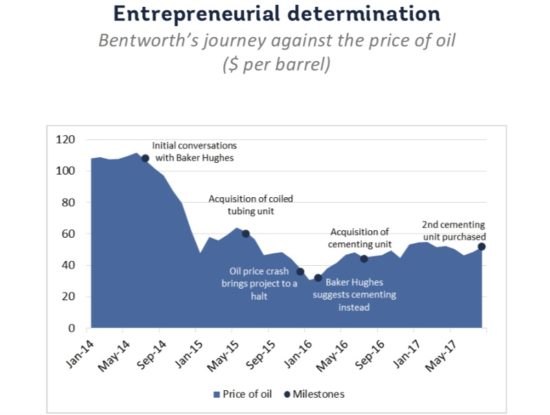

“Carey financed the initial $2 million required for the coiled tubing unit from local banks, funding the operating cost himself.”

The initial endeavour did not go to plan and disaster struck, oil prices plummeted and Tullow’s work came to a sudden stop. “With a large debt to service and no corresponding income, this young firm’s days were numbered.”

“Baker Hughes came to Bentworth with an idea to solve the problem: Tullow still needed a cementing unit, which could serve as a substitute opportunity for Bentworth…… To successfully leverage this new opportunity, Bentworth would need to dramatically up its game.”

“Once again, the close partnership between Baker Hughes and Bentworth proved pivotal to meeting this challenge. Bentworth increased its workforce to fourteen staff: three expatriates and eleven Kenyans. These staff were trained by Baker Hughes prior to starting at Bentworth to ensure they were appropriately skilled. Baker Hughes again provided the blueprints and technical assistance required.”

“This effort has paid off. Through dedicated execution, close collaboration with Baker Hughes and a willingness to take risk, Carey has successfully gained a foothold in Kenya’s oil and gas sector.”

Please note that the above are excerpts. Read the full case study by clicking on the image below: